Paygine - Open Financial Blockchain platform for Fintech and Crypto business

ABOUT PAYGINE:

Paygine is an open financial platform designed to operate within its own proprietary banking structure and designed to serve FinTech and crypto-business needs in areas of money remittance, cryptocurrency exchange, and payment for “real” goods and services under white label solution. Based on the needs of international banks and financial organizations, the founders of Best2Pay decided to create a new platform united by a single IT system with an open API. Paygine’s key competitive advantage over similar projects is that it can leverage off existing Best2Pay services and technologies currently used by FinTech businesses, e-commerce, and beyond. The Paygine platform would offer the following services by utilizing Best2Pay existing technology:Transferring cryptocurrency to/from a bank card :

• Paying in shops and stores using a card in cryptocurrency;

• Accepting cryptocurrency as a payment for goods and services at online stores;

• Carrying out cross-border transfers of fiat currencies by means of cryptocurrency with minimal costs;

• Maintaining wallets in both fiat currencies and cryptocurrencies with the ability to conveniently and quickly convert funds between them.

How It All Started

We came up with the idea to build an open financial platform that includes own banks (banks owned by platform founders) in 2017. At that time, we, together with our partners, were launching a bitcoin-based remittance system for money transfers from the US to Mexico. We have developed an IT-system, resolved all legal issues with the assistance of lawyers, and obtained a legal opinion that confirmed the legality of our operations and actions. It seemed that only one small thing was lacking to find banks that were ready to cooperate and there our problems began. As soon as they learned we were going to use Bitcoin as a payment method, banks would immediately refuse to service us, despite all the documents and legal opinions provided.We faced the same problem when we tried to set up a last-mile remittance service in Europe. All solutions were way too complex with a multitude of intermediaries and did not guarantee to operate stably for more than 1 or 2 months, even given that, in addition to having the legal opinion, we complied with all AML/KYC requirements. But this was no help. Banks and financial institutions simply refused to work with us when they heard “bitcoin”, for no real reason at all!

Our focus is developing solutions for the financial sector.

Today we work with more than 50 clients - banks and collection agencies

Best2Pay is fast and simple

• Our technological solutions allow our clients to start accepting online payments in

one day.

• Best2Pay platform allows to implement any complex project that take into account

unique specific of business-processes, infrastructure and target client audience of

our clients.

Best2Pay is beneficial

• Best2Pay has a certificate of compliance with the international PCI DSS security

requirements of the highest level—Level 1.

• Our servers are located in data-centers of different countries.

Best2Pay is safe

• Best2Pay is the only participant of the special program «Bill Payments» from Visa

International.

• «Bill Payments» service reduces the cost of the transaction interchange fee by 42.8%

and allows Best2Pay to offer the most favorable conditions for banks.

Best2Pay is up to date

• Best2Pay is always evolving for the modern world, a new product has been created

for aggregators that connect private individuals such as YouDo, Avito, airbnb, etc.

Problems of the cryptocurrency market

Currently, the cryptocurrency market is a multibillion dollar business. It is possible to buy and sell cryptocurrency by personal agreement between owners or on the relevant exchange. An example of a country with a progressive approach to cryptocurrencies is Japan, which in 2017 stated that crypto-currency exchange is legal regulated activity. On April 1st of the same year, Japan amended the Payment Services Act to allow “virtual currencies” as a legal form of payment. In September, Financial Services Agency, approved the operation of 11 cryptocurrency exchanges. Today, it is already impossible to ignore the existence of cryptocurrency and blockchain technology, and therefore, certain governments and industry leaders are working on integrating blockchain technology and cryptocurrency in various aspects of their economies.

The Paygine platform would allow for the use of cryptocurrencies in transfers andpayments that are typically done using traditional payment instruments:

• transferring cryptocurrency to a physical card.

• paying in shops and stores using a card in cryptocurrency.

• accepting cryptocurrency as a payment for goods and services of online stores.

• carrying out cross-border transfers of fiat currencies by means of cryptocurrency with minimal costs.

• maintaining wallets in both fiat currencies and cryptocurrencies with the ability to conveniently and quickly convert funds between them.

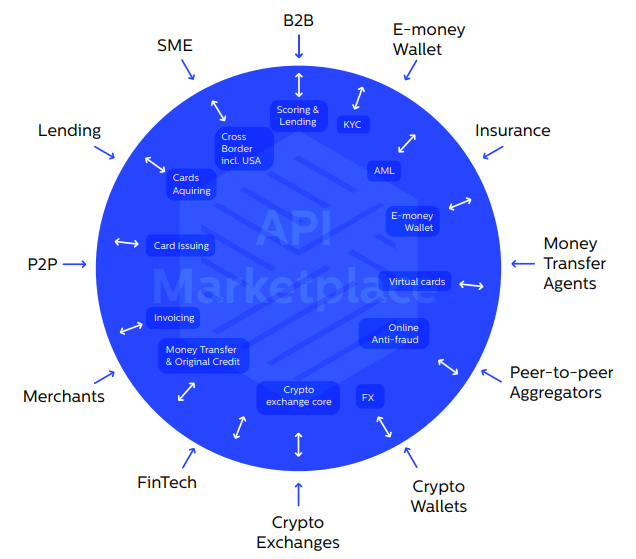

Explaining the Paygine ecosystem.

What services can be available to our clients on the Paygine platform after the ICO?

Peer-to-peer aggregator platforms that integrate people to sell products or provide services directly, without intermediaries, such as airbnb, Avito, Uber, Freelance.ru and others:

• Internet acquiring/e-invoicing , and other online payment services;

• International and domestic card to card money transfers;

• International card payments (mass payments, payroll);

• Peer-to-peer service for private individuals;

• Maintenance of private individuals’ accounts, providing APIs for flexible integrations with Customers Solutions (white-label bank)

• Know Your Customer procedures (KYC) procedures;

• Card issuance;

• E-wallet;

• Money transfer services;

• Deposit and withdraw between accounts, wallets, and card using fiat

money and cryptocurrency.

Various services for creating wallets and crypto-wallets.

• Internet acquiring.

• International and domestic card to card money transfers.

• International card payments (mass payments, payroll).

• Maintenance of private individuals accounts, providing APIs for flexible integrations with Customers Solutions (white-label bank).

• Know Your Customer procedures (KYC) procedures.

• E-wallet.

• Card issuance.

• Exchange of fiat to cryptocurrency.

• Payment processing for cryptocurrency-accepting merchants.

• Crypto trading.

• Deposit and withdraw between accounts, wallets, and card using fiat money and cryptocurrency.

Solutions for international money transfers on the basis of cryptocurrency:

• Internet acquiring.

• International and domestic card to card money transfers.

• International card payments (mass payments, payroll).

• Maintenance of private individuals’ accounts, providing APIs for flexible integrations with Customers Solutions (white-label bank).

• Know Your Customer procedures(KYC) procedures.

• E-wallet.

• Card issuance.

• Exchange of fiat to cryptocurrency.

• Providing the first and the last miles for international money transfer services.

• Money transfer services.

• Crypto trading.

• Deposit in accounts, wallets and cards, direct debit, using cash, cryptocurrency, etc.

• Deposit and withdraw between accounts, wallets, and card using fiat money and cryptocurrency.

Which services will be available immediately on the Paygine platform?

• Internet acquiring.

• E-invoicing.

• International card to card money transfers.

• Transfers from card to account, loans repayment, direct debit.

• International card payments (mass payments, payroll).

• Peer-to-peer service for private individuals in three modes.

• Customers are registered on the platform and directly pay forthe services of contractors (service provider) from their accounts.

• Contractors (service providers) register on the platform and directly collect money for their goods or services from customers, and then deposit collected funds to their own accounts or cards.

• Secure transactions can be made using the platform funds are debited from the customer’s account and held (similar to an escrow account). After the successful completion of a transaction, the funds are transferred to the contractor, if the transaction fails, they are returned to the customer.

• Fraud detection.

Stage I

How services are provided.

How services are provided for those who want to know more organizational scheme of work

Stage II

Our business will focus mainly on FinTech companies who desire to work with customers around the world with particular emphasis on larger markets, such as the United States. But working with Americans is not a simple task, especially when it comes to providing financial services, because the US law is very complex and contains many nuances that must be taken into account, such as differing regulations for doing business in different states. We support our clients’ focus on the larger markets, and therefore will ensure that our platform is fully compliant with the applicable regulations in the US and other larger markets.

To do this, we have already established a Paygine representative office in the US and will work to obtain a money-transmitter license (MTL) in each state. We plan to start by registering and obtaining MTLs in three states: California, Texas, and Colorado, and then follow suit in all other states. Obtaining a MTL can take from several months up to several years. Therefore, to get a head start, we are already negotiating with local companies that have MTLs. Organization of work in the US and obtaining MTLs will allow us to do the following:

• provide the last mile for transfers to the US and the first mile for transfers from the US;

• provide all the services implemented in earlier stages to the US market; and

• launch international transfer services in a white label model from the United States, South America, Europe, and other parts of the world.

How services are provided.

Organizational scheme of work.

Stage III

The development of the Paygine platform will entail a significant increase in transfers, within and between countries where clients carry out business. In addition, an increasing number of businesses will begin to make transfers in cryptocurrency. This will impose increased demands on the stability of the Paygine platform and the implementation of uninterrupted settlements inside it. In order to eliminate various risks during Stage III, we plan to open additional Paygine bank branches in Southeast Asia and the U.S. so that we can provide extended services to new users.

This will allow us to:

• provide Paygine’s services to companies operating in Southeast Asia.

• provide microloans to regular clients.

• assess the credit risks of private individuals and legal entities working on the Paygine platform.

• work with the regulators for direct connection to the national/regional payment system.

Project

roadmap

We divided the three stages of the Paygine platform development described above into three stages of implementation. The implementation of these stages depends on the amount of raised in the ICO process. All these stages can be run simultaneously if the full amount is raised. The cost of each stage includes both the cost of implementation and the maintenance of activities during the year. The total amount for the implementation of all three stages is estimated to be $43,454,000. Operational costs for the first three years of operations are estimated to be approximately $22,260,000. Estimated total cost of the project for the following three years (taking into account passing the break-even point after 2.5 years of activity) will be approximately $66,000,000 (this amount includes implementation and operational costs for three years).

ICO structure

The ICO of Paygine’s crypto financial platform will consist of two stages:

Pre-ICO and ICO.

Purchase currency : BTC, ETH,fiat currency

Minimum amount needed to launch the project: : $3 000 000

Maximum amount : $30 000 000

Tokens distribution

Explanation:

27.9% of all tokens will be distributed among the token purchasers.

14.7% will be distributed among the project team members.

0.8% will be reserved for bounty.

56.6% are assigned for reserve (putting on hold for two years, pegged in a smart contract).

During the ICO, 42,7 million PGC tokens will be presented for sale. All unsold tokens will be reserved for future use and will be kept by Paygine platform.

The Team.

Kirill Radchenko

CEO of Paygine LLC (US); Сo-founder of Pay Engine Limited (UK)

Kirill Radchenko has been working as CEO of Best2Pay, one of the leading e-commerce gateways. He is responsible for the company’s main strategy and business development. Previously, Kirill worked for SEB Bank (SEB Group, Sweden) for over 6.5 years, first as head of its payment cards division, then as head of business development. Kirill has 13+ years of experience managing IT projects, business planning, and developing bank products at an international company. He has in-depth knowledge of the rules and regulations of VISA and MasterCard, and cards processing.

Michael LuposhtyanSenior Vice President of Paygine LLC (US); Сo-founder of Pay Engine Limited (UK)

Michael Luposhtyan was CEO of Pay Engine Limited, UK, until 2012.

He has worked in businesses related to international payments since

2011. From 1993 to 2011, he worked in the international container

transportation field, working in customs clearance and freight

forwarding through the sea-trading port of St. Petersburg. He was also

a general director at a customs broker, deputy director of a branch at a

steamship company, and has held other positions.

Maxim Neshcheret Business Development Director of Paygine LLC (US); Owner of KRUT PTE LTD (Singapore)

Maxim has 12 years of experience implementing large-scale, nationwide

financial solutions all around the world. Projects include

implementation of national retail-payments solutions under central

banks’ mandates, central depository systems for central banks and

stock exchanges, and multiple projects for commercial banks.

Raniya Luposhtyan

CFO of Paygine LLC (US); Co-founder of Pay Engine Limited (UK)

Raniya Luposhtyan has been a shareholder of Pay Engine Limited

(Best2Pay) for the past five years. Raniya has more than 10 years

of experience in consumer banking, with ABN AMRO Bank, Bank

Renaissance Capital, and Banque Societe Generale Vostok, leading,

implementing, developing, and maintaining credit initiation, customer

service, and regional development. She also has five years of experience

at Sberbank, in the banking transfers and credit cards group.

Alexander Petrov

Chief Technology Officer of Best2Pay (Russia)

Alexander Petrov has been working as director of cards technologies

for one of the top 10 banks in Russia. He is responsible for the

development of cards, acquiring, and e-commerce-related services,

as well as for the operation of systems that those services function

on. Previously, Alexander worked for Raiffeisenbank for over 10 years,

first as head of processing and then as head of banking cards division.

Alexander has 15-plus years of experience in cards, payments, and

payment schemes

RBM Advisory Team Members

Azat Nugumanov Partner

Azat is a former director at Morgan Stanley Private Banking, based in New

York. Priorto that he worked as a vice president at BNY Mellon’s Moscow

office, where he was responsible for business development. Azat also

cofounded the firm Aneta McCoyAdvisory. He has expertise in wealth

management and experience in capital markets. He obtained a master’s

degree in business administration from the University of Chicago Booth

School of Business.

Anastasia Klimenko Vice President

Anastasia Klimenko is an attorney practicing corporate and international

law, mergers and acquisitions law, and litigation. She earned her master’s

degree from Duke University School of Law and her bachelor’s degree

in Civil Law from Moscow State Academy of Law. She is a member of the

NewYork State Bar Association

Gary J Ross

Partner, Ross & Shulga PLLC

GaryJ. Ross focuses his practice on securities law, venture capital and

private equity, corporate governance, and general corporate matters. Gary

represents private companies (at all stages), including those exploring

blockchain/cryptocurrency opportunities, as well as angel investors

and investment funds. Gary has extensive experience advising on SECregistered

and exempt capital markets transactions, including initial public

offerings of common and preferred equity, debt offerings, and initial

coin offerings. Gary regularly counsels registered and exempt investment

advisers as to compliance issues. His experience also includes expert

witness engagement in commercial litigation matters. Prior to founding

Ross & Shulga PLLC’s predecessor firm Jackson Ross PLLC in 2013, Mr. Ross

worked in the Capital Markets and Corporate Transactions & Securities

practice groups at SidleyAustin LLP and Alston & Bird LLP, respectively.

From 2009 to 2012, Mr. Ross served in the US Department of the Treasury,

where he oversaw contractors and financial agents engaged bytheTreasury

to provide asset management, advisory, and other services relating to the

Troubled Asset Relief Program (TARP).

RBM Advisory Team Members

Arina Shulga Partner, Ross & Shulga PLLC

Arina Shulga is a corporate and securities attorney with significant experience

in start-up law, securities offerings and general business representation.

She is experienced with advising small to midsize companies on formation,

contract review and negotiation, private placement of securities, intellectual

property matters, and internal governance issues. Before founding Ross &

Shulga PLLC’s predecessor firm Shulga Law Firm PC in 2010, Arina spent

seven years at Cleary Gottlieb Steen & Hamilton LLP

Salah Abci Partner, Grant Thornton

Salah Abci is a professional holding partner position in Grant Thornton,

Algeria. Salah has a demonstrated history of working in the financial services

industry, including Central Bank of Algeria. Skilled in Negotiation, Risk

Management, Corporate Finance and IFRS. Having strong entrepreneurship

experience that is focused on Economics, Finance, Accounting and Banking

he is helping Paygine team to build perfect platform for FinTech community.

Byanmunkh Volodya Director, “Truly Digital Bank”

In parallel with Paygine project, Byanmunkh is running “Truly Digital

Bank” project in Mongolia, aiming to build first digital bank in Mongolia.

Byanmunkh experience includes projects implementation in Central

bank of Mongolia, Mongolian Stock Exchange and number of commercial

banks. You can refer to his LinkedIn page for more details.

Djibril Diallo

Vice-President, TransferTo

Djibrill possess valuable experience for Paygine team related to mobile

payments, remittances and product development for banks and

telecom operators.

More information :

Twitter: https://twitter.com/paygine

Facebook: https://www.facebook.com/Paygine/

Telegram: https://t.me/PaygineBounty

Reddit: https://www.reddit.com/user/Paygine

YouTube: https://www.youtube.com/channel/UCgNWuzUVd-Tn8_envSSjRUw

Whitepaper: https://www.paygine.com/assets/helpers/files/en.pdf

Situs web: https://www.paygine.com/

Facebook: https://www.facebook.com/Paygine/

Telegram: https://t.me/PaygineBounty

Reddit: https://www.reddit.com/user/Paygine

YouTube: https://www.youtube.com/channel/UCgNWuzUVd-Tn8_envSSjRUw

Whitepaper: https://www.paygine.com/assets/helpers/files/en.pdf

Situs web: https://www.paygine.com/

Author : nararifki

bitcointalk link : https://bitcointalk.org/index.php?action=profile;u=1253091

ERC20 : 0xE50A8687eE1873b7631906B9eDa9C3E795AbEcBC

i will joined airdrop

BalasHapus